This will be a series of EDU Content so TAKE YOUR TIME and go through it carefully. This is PART 1. of a whole bunch of content I plan to release from mindset to Depth of Market “DOM”, the TAPE to ORDERFLOW. We will cover ALL THE BASES! 😎

VOLUME PROFILE SECTIONS:

What is Volume when it comes to trading?

What are NODES?

HIGH vs LOW volume NODES

Value Area - $ Price Rotation

3 KEY Parts of VALUE Area? “VAH” “VAL” “POC”

Types of “Time Per Profile”

4 Common Volume Profile SHAPES - D P B b

How to use for ENTRY/ EXIT

ABOUT ME - WHY DO I DO ALL THIS FOR FREE? For YOU!

Daily Game Plan - What Is That?

1. What is VOLUME when it comes to trade?

It represents the number of shares/contracts of a security “stock” traded between buyers and sellers “you and me”. When trading stocks volume is in number of shares. In futures and options it is measured in contracts.

With volume profile instead of it being on the X axis “bottom” of the chart it is on the Y axis “left" side horizontally. In the picture below it is the BLUE Sideways bars.

Volume profile shows us volume traded for a SPECIFIC PRICE instead of time like market profile. Two different types of profile.

Every time a contract is traded the volume profile builds out to the right as more and more contracts are traded at that price.

2. NODES: What are nodes?

When you zoom all the way in on volume profile you can see the size of each node. These price levels are called nodes and measure the amount of contracts traded within a specific price point.

3. HIGH Volume Nodes vs LOW Volume NODES.

HIGH Volume Nodes: (GREEN ARROWS —> in picture below) Are were a HIGH number of contracts are traded so it is slow for price to move through these nodes sometimes.

BALANCE - When there are high volume nodes it means there is balance forming and that market participants agree on a price also know as “fair value”

LOW Volume Nodes: (RED ARROWS —> in picture below) Are were a LOW number of contracts are traded so it is fast for price to move through these nodes usually.

IMBALANCE - When there is a market imbalance price moves very fast until it finds a “fair” value.

Sometimes price will move quickly to a LOW NODE which they call vacuums so sometimes they will wick to them. (Look at where the wicks are in the picture and they are where the LOW Volume Nodes are.

4. EXAMPLE: See Picture Below of “PRICE ROTATION”

RED - LOW Vol. NODE Section

GREEN - HIGH Vol. NODE Section

HIGH VOLUME NODES: (GREEN BOX —> in picture below) Usually accept price and a range bound rotation of the profile will take price where price will hang around for awhile while it accepts a previous fair value price.

LOW VOLUME NODES: (RED BOX —> in picture below) Usually reject price and are moved back to a high volume node area.

5. 3 KEY Parts of VALUE Area? “VAH” “VAL” “POC”

Value area is where 70% of the accumulated volume takes place within that profile. I personally use 68% and some others use that too as 68% represents the “empirical rule” which tells you where most of the values lie in a normal distribution. 68% of value is within 1 deviation of the mean.

Value Area “VA” - The ORANGE highlighted 68% section is the VA!

Value Area HIGH “VAH” - The highest price of the value area.

POINT of CONTROL - Where the MOST amount of volume takes place.

Value Area LOW “VAL” - The lowest price of the value area.

6. Types of “Time Per PROFILE” ?

You can use a DAILY Profile which builds 1 profile per day or a weekly profile which builds a profile for the week!

You can even do minute, hour, week, month, quaterly. Most common is day and week.

7. Common Volume Profile Shapes - D, P, B, b,

There are 4 common patterns with volume profile that are have a meaning and can give clues as to direction of where the market is!

“D” Shape Profile

A “D” shape profile is a balanced profile that has sideways action and range. usually choppy when there is a D profile as it’s a period of consolidation. This range can be noted for breakout trades once it leaves outside the profile.

“P” Shape Profile

A “P” shape profile is when a breakout occurs then consolidation occurs. Remember how we talked about LOW volume NODES, see how fast price moved through the low volume nodes it did not find balance or “fair” price until the top of the P profile within the value area “VA”. A “P” shape is usually formed when shorts are covering.

“B” Shape Profile

The “B” shape is similar to the D profile but slightly different. See how PRICE hung around for a while in BOTH top and bottom section of the B balanced took place within each portion of the B and could be said to have 2 value areas. However The bottom portion if where most of the volume took price as was more dominant.

“b” Shape Profile

A LOWERCASE “b” shape profile is formed when price falls or rises sharply then consolidates. Unlike a “P” profile, a “b” profile can represent a long liquidation that took place. They are usually found in downtrends before balance is found.

SPECIAL EXAMPLE - VERY UNIQUE CASE In Picture:

See how on the LEFT we a “b” price hovered around the bottom then violently ripped higher and we have a lot of LOW VOLUME NODES. Price rejected it the next day as that was an imbalance and no “fair” price was agreed on up there.

On the RIGHT the next day since price rejected it came right down and did not agree price was “fair” at the previous day point of control “POC” It went slightly lower and build a value area half of yesterdays profile from the previous day POC which became the value area high “VH” of the second day and then the new low was below the previous day value area low “VL”

8. How To Use Volume Profile for ENTRY / EXIT

So each morning when the market opens I look at the PREVIOUS DAY Point of Control “PD POC” to see if we are opening above or below. I also chart out manually the lines of vPOCs and PD POC VH VL.

You can click the drawing tool and click price level and plot out the level. Then RIGHT CLICK and change the settings to the second picture and type in a name. RIGHT EXTENSION “ON”, SHOW NAME “On The Right” and SHOW PRICE LEVEL"On The Right”. You can even create a drawing set and call it 5m “for the 5min chart you have your levels plotted for the 5min or 1min intra day time frame and then on the 30min chart the plot levels are not in the way of the Volume Profile as you can see in my example below I have a drawing set called “blank”.

Scroll down to see how I use these levels for entry and exit.

For TradingView use the “horizontal ray” and right click same settings".

OPEN BELOW PD POC: If we open above the PD POC I look to play the upside as if we bounce and hold the PD POC or or just continue to rip higher I look at the PD value area high “PD VH. If we get through that the next VL or POC called a V POC “VIRGIN POINT OF CONTROL” an untested level of heavy volume. Can often act as a strong magnet or heavy resistance once tested. If we gap over a vPOC I take not of that and look at the levels above but that level is still in play since it is yet to be tested. Previous vPOCs that have been tested may be tested again and can offer support or resistance.

OPEN BELOW PD POC: If we open below the PD POC I look to play the downside as if we bounce the first level of resistance will be the PD POC. If we get through POC I look for a retest of POC or strength and momentum then play the “OPEN ABOVE POC" levels. If we reject PD POC, I look for the break to the downside and see if we slide down to previous day value area low “PD VL”. If that does not offer support I look at the next levels of days in that range of VH, POC and VL levels that may offer support. Sometimes I look at weekly chart to get a big picture perspective as if we are above the weekly POC or BELOW.

PICTURE EXAMPLE:

AMD Is a good example but can apply to any chart.

The PD VH provided resistance today and was rejected. We came back down to PD POC after breaking daily and weekly vwap. If we stayed above it a candle open and close above vWAP, we would have possibly tested and broke above PD VH otherwise a double top pattern would have formed.

End of the day we came below the PD POC and closed well below today’s POC so a bearish signal unless we gap up.

On the weekly timeframe look to the right. The RED LINE 103.27 level was a WEEKLY vPOC that was NOT TESTED until we had a pop to that zone. It was a SHARP rejection and came right back down. That will be the key level to break once we get back above the weekly VH of 100.16

This is just an example of how I play entry and exits based off POC VH VL.

9. MY Volume Profile Setup!

WARNING SO YOU SEE CORRECT VALUES!!!!!

VOLUME PROFILE works mainly on 30min chart where most people get their values from. IF you use a 5min chart with volume profile you will get different levels.

I use “EXTENDED HOURS” ON for futures only like /ES /NQ but for STOCKS I TURN OFF “EXTENDED HOURS”.

I use think or swim and will provide a ThinkorSwim layout and a Trading View setup!

Trading View

To use Volume Profile you must have an upgraded account.

ONLY WORKS ON 30min so chart out those levels so you can use 5min etc using the “HORIZONTAL RAY” Line Draw Tool

Click "COPY" top right to save the template for yourself

https://www.tradingview.com/chart/efVAVGVq/

ThinkorSwim

A Standard Version with how to setup volume profile and then my FULLY CUSTOM SETUP WITH INDICATORS

⚠️⚠️READ everything below so you understand how to configure the profile! ⚠️⚠️

To IMPORT this layout 5 Easy Steps:

Click “SETUP” TOP RIGHT of thinkorswim

Click “OPEN SHARED ITEM”

Paste the link below into the blank box! CHECK “open shared items after I press import” (SCROLL DOWN)

It will open in a separate window. CLICK on the GRID icon then click “SAVE Flexible Grid As” and type whatever name you will like.

Then click “EDIT STUDIES”

Then click the “GEAR” icon to the right of the X.

From here you can edit the color and settings from “DAY” to “WEEK” if you want too. (SCROLL DOWN FOR CUSTOM COLOR)

PLOTS vs GLOBAL - to change the VALUE AREA highlighted it is under “GLOBAL”

Click “MORE” from here select “HSV” at the top and then change it to whatever color you and then the transparency to 50% or higher.

May have to play with which level is comfortable for you as I use 85%

LINK for GRID LAYOUT - http://tos.mx/dh7qtp1

My Custom Setup:

CUSTOM LABELS: Labels at the top chart show the POC VL VH for the day and then the PREVIOUS Day Values. RED if price is below the value and GREEN if price is above the value.

2 Layouts - 1 Intraday - 1 Post Market Review

SEE BELOW as when you import it MAY NOT LOAD CORRECTLY so FOLLOW INSTRUCTIONS HOW TO FIX is AT THE BOTTOM of this!!!

So I have 2 layouts I use.

Intraday layout - 5min chart for while I am watching the Depth of Market and also have a 15min and 30min chart to watch as well. At the bottom you can put your Contacts you are watching for options! Just right click on any contract under “trade tab” and paste it where you would type the symbol.

http://tos.mx/TlnpDNd

Post market review - 30min chart for charting all levels and then a daily and weekly profile chart! I ONLY CHART MY levels on this grid layout and 30min timeframe only!

http://tos.mx/ENz3x0R

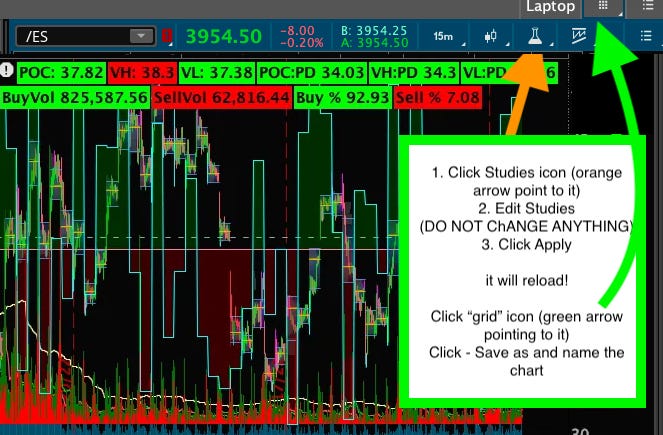

IMPORT Layout FIX - Like Below!

If it shows the VOLUME Lower Intraday Study on the chat - it SHOULD NOT

DO THE FOLLOW TO FIX IT!:

THEN MAKE SURE TO SAVE Flexible Grid and layout!

!

10. ABOUT ME:

For new traders I recommend to take it very slow. When you do options especially pick 2-3 days out or a week. Key is to buy yourself time. 0DTE (day till expiration is when contract ends the same day) you will get premium killed (value of your contract)

Also another thing is when you play off someones buy and sell signals it doesn’t teach you anything. It is an alert from someone which gives you confidence in a trade and if it doesn’t work out the person will get upset about the alert. Also with the alert if I was posting buy and sell by the time I buy it will be different price then what you or someone else may pay, if it goes the wrong way and I said “sell” you will then panic to sell where I could have been wrong and it runs or you are dumping for a loss with all the others.

When learning to trade you must understand the WHY

- Why should I take this trade

- Where will I cut it if it doesn’t work out? 5% or X level

- Where do I scale out? Price target 1 x 2 here and 3 so n - most if they see green keep holding till the trade goes red, then keep holding till it goes to 0 cuz they are in denial and hope it goes back up.

- You can’t trade off emotions and following people alerts.

What if they shut their alert service down you learned nothing and won’t know how to trade and just find another alert service to pay for to chat slap their alerts. In a bad cycle of following alerts will never work out.

I believe in education and teaching people to fish for a lifetime not provide them with a fish for a day.

Once you grasp the basics, take 1 contract start with 1 contract and take it very slow this is not a get rich game trading, it takes discipline and patience. Some days I don’t trade if I don’t like the chop or in between my levels. I wait for my levels to hit and then take position based on if we broke through a level to the upside then pulled back and back tested it and it held. If it rejected I would play the downside.

I also have a Daily Game Plan Posted EVERY NIGHT that goes over the following stock plus 3 BONUS STOCKS that the members pick. Any other requests I chart out and post in the group chat!

FUTURES - /ES & /NQ

ETFs - QQQ (tech) & IWM (small caps)

VIX - Volatility Index

TECH STOCKS - AAPL / MSFT

CHIP STOCKS - AMD / NVDA

BIG 3 - TSLA / AMZN / GOOGL

If you want to get the DAILY Game plan click “SUBSCRIBE NOW” below!

Did you enjoy this substack?

Smash that Like Button ❤️ & Leave a Comment! 💬

Please share and subscribe for FREE for daily stock review!

Click to Join Free Charts & Notifications about new posts and Intra Day Charts

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Think or Swim. I am just an end user with no affiliations with them.

Thank you so much for being so kind. I appreciate and ❤️ you. God bless you!🤗

Not only excellent Information but Free, Hard to believe, This days and age.